Much has been talked about the down trend of Australian dollar (AUD). It is one of the worst currency in 2014 against its major peers. However, it has rebounded since 2016 and strongly in 2017 against many major currencies. AUD weakened further in 2018. If you are a Singapore investor interested in Australia properties mortgages, you should keep a close watch on the AUD vs SGD trend.

Why is AUD Sliding?

Australia economy is experiencing a slow down for the past years. As mining boom fizzles out and China economy slows down, it’s inevitable that Australia is reversing its bull run. In order to boost the economy, RBA has on many occasions publicly stated that AUD is too strong and does not reflect the declining commodity prices. At the same time, RBA has slashed interest rates and maintained it at 2.5% for many months.

What now for AUD?

The market have seen the strengthening in AUD against major currencies. It has rebounded about 5% in 2016 against SGD, and 4-5% in 2017.From the last bottom of 99 cents against SGD, AUD has strengthend about 10% to 1.09 as of Jan 2017. This come on the back of strong commodity prices such as iron ore. The market note that mining industry is still not recovering and it may hold the AUD strength back a bit. Since the beginning of 2018, AUD has seek weakness with it recently hovering near par with SGD. With trade wars bickering between USA and China, Australia could be well affected if the war heats up given its economy is closely correlated with China. AUD is at 1.01 level against SGD as of early April 2018.

AUD vs SGD Trend

Australia mortgages offered by banks in Singapore are pegged to AUD or SGD. There were multi-currency mortgage products that allow switching between AUD and SGD, however they are no longer offered with the closure of the banks. With your employment income in SGD and rental received in AUD, any savvy investor should be aware of the AUD vs SGD trend and learn how to benefit from it.

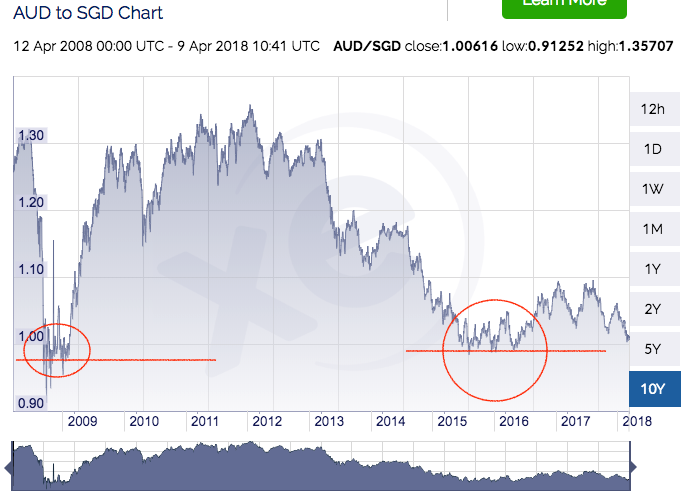

We extracted a 10-year chart from XE.com plotting AUD vs SGD.

Look at the 2 lines drawn over the last 10-year period (2008-2018). Those were the 2 occasions where AUD weakened below par. On one occasion in 2009, it breaches par level and AUD slides to below $1 against SGD. This was during the global financial crisis. Not too long later, it climbed up. In 2010, it fell to $1.15 and after few months, AUD grew in strength. From 2009 to 2013, AUD was much stronger than SGD and traded around a range of $1.20 to $1.30. On another occasion between 2015-2016, it reached the parity level last seen during the GFC. Since then, it has rebounded about 10% in 2016 and 2017. Now in 2018, it is almost par again.

Where Can AUD/ SGD Go To?

With reference from the all-time chart published here, AUD traded below $1.15 in 2 periods, in the early 2000s and 2013. And it rebounded. As seen above, it touched below $0.90 in 2015 and is creeping back. We used to watch the $1 level for opportunities to convert SGD to AUD. This opportunity is here again. You can take advantage by using WorldFirst remittance services with their lowest guaranteed rates and zero fees benefits.

If you are interested in Australia mortgage products, check out our products from Singapore and Australia banks and lenders.