Recently, there’s an article in Straits Times about rising interest rates. We will dig deeper to look at what exactly is increasing for Singapore home loans.

In the article, it mentioned about interest rates made up of 2 components, namely the market rate and a premium charged by the bank.

Market rate is usually the Singapore Interbank Offered Rate (Sibor) and/ or the Swap Offer Rate (SOR). In some cases, board rates are offered. The SIBOR and SOR rates are often offered on a 1- and 3-month basis, known as 1-month SIBOR, 3-month SIBOR and 3-month SOR. These rates are floating by nature hence will vary.

Premium also known as margin or spread, is the additional rate on top of the market rate. For example, 3-month SIBOR plus 1% works out to be 1.375%, assuming 3-month SIBOR is 0.375%.

Is SIBOR rate moving up (really)?

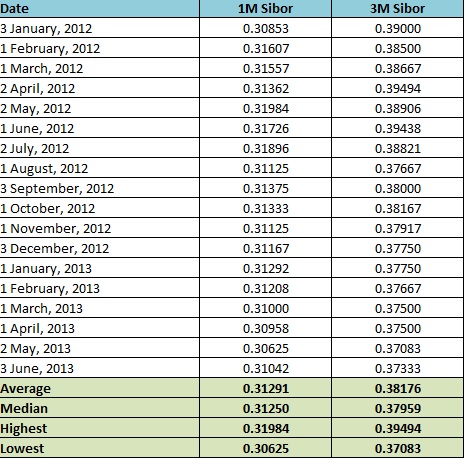

Using the historical SIBOR rates (1- and 3-month) from January 2012 to May 2013 in the table below, we noticed the following:

- The current 1- and 3-month SIBOR rates are lower than the average and median

- Current 1-month rate is about 1% lower than its average, while 3-month rate is 2% lower.

- Difference between the maximum and minimum touch points for 1-month rate is 4% from the lowest, and it’s 7% for 3-month SIBOR. However these percentages translate to 0.01359 and 0.02411 which have insignificant impact.

How about the trend of the premium charged by banks?

Considering that the premiums varies from banks and differs for types of properties and loan amounts, it’s relatively difficult to analyze in a consistent manner. We have been describing the housing loan trends for 2013 and 2012. It’s quite clear that the overall direction is a gradual increase in the premiums.

- June 2012 – Standard Chartered offered 0.75% for year 1-3

- July 2012 – ANZ had a 0.8% throughout the loan tenure

- September 2012 – DBS introduced 0.75% for year 1-3 and 1% from year 4 onwards

- October 2012 – Bank of China pushed a promotion with 0.7% for year 1-3 and 1.1% thereafter

- Feburary 2012 – State Bank of India revised it to 0.9% average for year 1-3

- March 2013 – Bank of China offered 0.88% for year 1-3

- April 2013 – ANZ introduced 0.9% throughout for selected tie-up projects

- May 2013 – Most SIBOR packages has a premium of 1.25% from year 4 onwards

What can you tell about the overall trend of interest rates?

1- and 3-month SIBOR rates are relatively stable with minimal changes since 2012. Both are still hovering at the all-time low. The premium trend paints a mixed picture. Depending on promotions, the initial teaser premiums are range-bound between 0.8%-0.9%. However it has definitely increased from year 4 onwards. SIBOR is pretty much not within our control since it’s a market rate, just like stock prices. There is no difference between banks that offer the same 3-month SIBOR loan packages. On the other hand, choosing a home loan package with lower premiums is certainly in your hands. Your choice will depend on whether the property is for own use or investment, holding period, your outlook on the premium and SIBOR, etc.

If given a choice, will you secure a SIBOR loan that offers a low premium from year 4 onwards? Or will you take up one with teaser interest rates in the first 3 years, refinance in 2016 and hope to find one with a lower premium than what’s offered today? Check out the loan options at the Refinance calculator page.

Contact us today for the best mortgage advice!