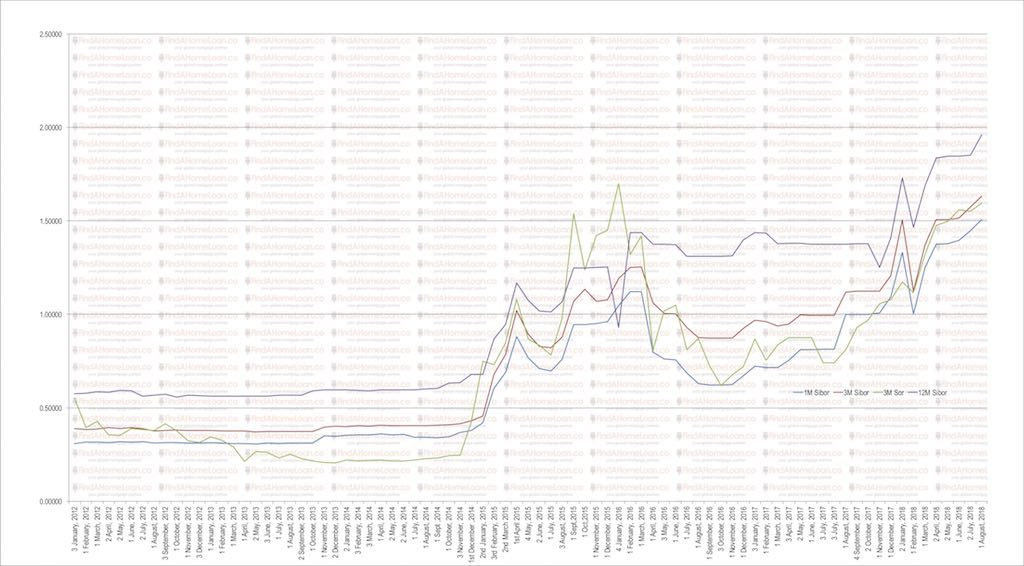

We publish 2018 chart and rates for Singapore dollars SIBOR and SOR, up-to-date from January. Learn to compare 1-month and 3-month SIBOR and 3-month SOR. View the historical trends of SIBOR and SOR from 2012 onwards.

Effective 01 January 2014, all tenors of USD and SGD SIBOR will be discontinued and not published on Thomson Reuters. From 1 October 2015, SIBOR and SOR data will be subjected to usage fees, in line with global development on benchmark data usage. In addition, subscribers who receive real-time SIBOR and/or SOR data from a market data vendor will be required to pay end user fees. Hence we can only publish delayed monthly data.

At the bottom of this page, you will find links to the pages for other years of SIBOR and SOR.

Definitions

SIBOR: Singapore Interbank Offered Rate (SIBOR) and is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Singapore wholesale money market (or interbank market). SIBOR is quoted on 1-month and 3-month based on the 11am fixing by the ABS. It is then published in the Singapore Business Times on the next working day.

SOR: It is an FX-implied rate, calculated from a formula that includes USD/SGD forward rate and USD/SGD spot rate. After DBS acquisition of ANZ in Singapore, SOR-linked home loans are not offered. Bank of China in Singapore have also stopped marketing theirs.

2018 January to December SIBOR and SOR Rates

| MONTH (As of) | SIBOR 1 MONTH | SIBOR 3 MONTH | SIBOR 12 MONTH | SOR 3 MONTH |

| 3 Dec 2018 | 1.641 | 1.768 | 2.067 | |

| 1 Nov 2018 | 1.517 | 1.642 | 1.972 | |

| 1 Oct 2018 | 1.516 | 1.643 | 1.963 | |

| 3 Sep 2018 | 1.511 | 1.637 | 1.959 | |

| 1 Aug 2018 | 1.507 | 1.632 | 1.959 | 1.595 |

| 2 Jul 2018 | 1.4480 | 1.5748 | 1.851 | 1.55 |

| 1 Jun 2018 | 1.395 | 1.514 | 1.847 | 1.56 |

| 2 May 2018 | 1.377 | 1.507 | 1.836 | 1.54787 |

| 2 Apr 2018 | 1.375 | 1.507 | 1.836 | 1.4759 |

| 1 Mar 2018 | 1.250 | 1.373 | 1.689 | 1.3217 |

| 1 Feb 2018 | 1.003 | 1.125 | 1.466 | 1.117 |

| 2 Jan 2018 | 1.331 | 1.504 | 1.731 | 1.1745 |

SOR and SIBOR Chart – From 2012 to 2018 Present

How is SIBOR calculated?

ABS Benchmarks Administration Co Pte Ltd (ABS Co.) was setup in June 2013 to own and administer the Singapore Interbank Offered Rate (SGD SIBOR), the Singapore Dollar Swap Offer Rate (SGD SOR), and others. ABS Co. has appointed Thomson Reuters, as the Calculation Agent to calculate and determine the Benchmarks on its behalf.

SIBOR is the rate at which an individual Contributor Bank could borrow funds, were it to do so by asking for and then accepting the interbank offers in reasonable market size, just prior to 11:00 a.m. Singapore time. There are 20 Contributor Banks on the SIBOR panel. Each Contributor Bank is selected and determined by the Administrator. A minimum of 12 Contributor Banks shall submit rates for each maturity (1-month, 3-month, 6-month and 12-month).

On each Business Day, Contributor Banks will contribute rates for the Singapore Interbank Offered Rate (SGD SIBOR) for deposits, just prior to 11:00 a.m. Singapore time. Each Contributor Bank shall contribute their rates without reference to rates contributed by other Banks. The rates shall be contributed up to five decimal places. Then the Administrator shall calculate and determine the Rate using trimmed arithmetic mean of the contributed rates. The contributed rates will be ranked in order, the top and bottom quartiles will be removed, with the remaining rates averaged arithmetically. The arithmetic mean shall be published as the Rate at 11:30 a.m.

SIBOR and SOR Historical Rates

Singapore Dollar SIBOR HistorySGD SIBOR 2020 |

Singapore Dollar SOR History

SGD SOR 2018 |

Contact us today for the best mortgage advice!