If you have a loan approaching or past the 3-year mark, it’s time to review the mortgage options. What should you do? We look at the factors affecting your next step (refinancing or repricing)

What is refinancing?

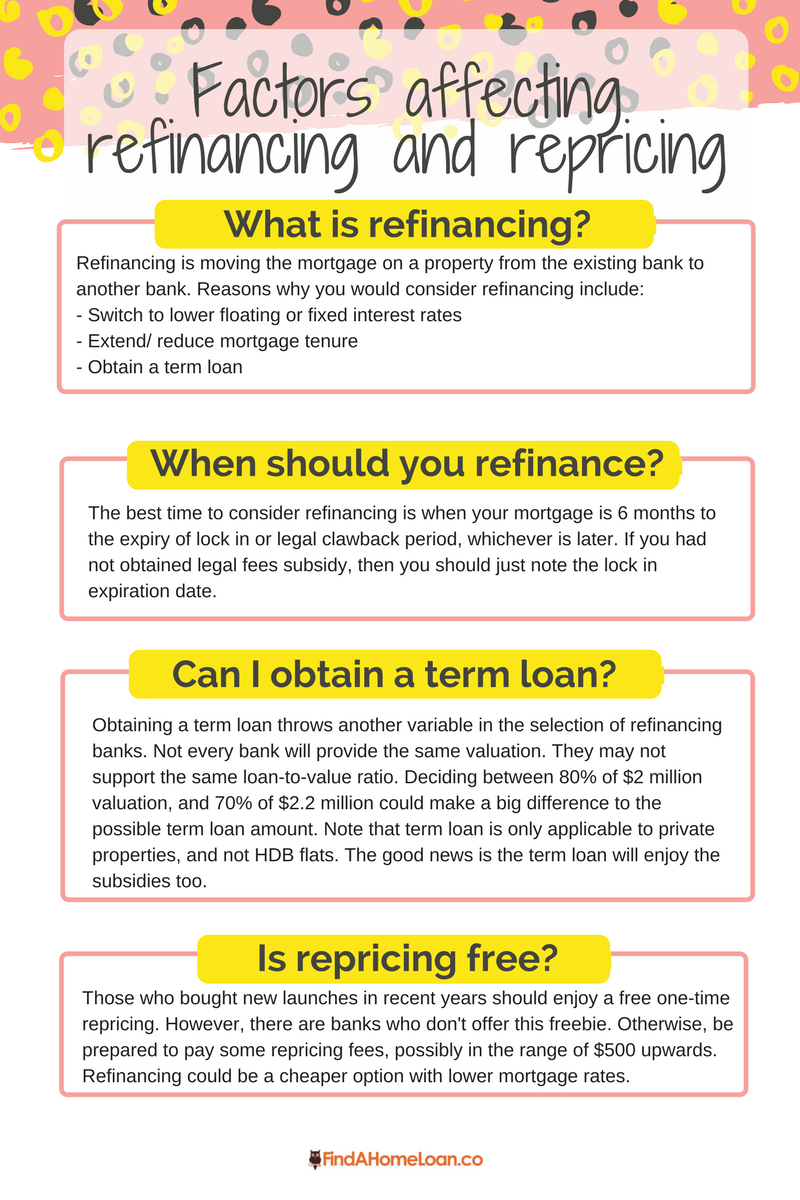

Refinancing is moving the mortgage on a property from the existing bank to another bank. Reasons why you would consider refinancing include:

- switch to lower floating or fixed interest rates

- extend/ reduce mortgage tenure

- obtain a term loan

If you have term loan secured on the same property, both loans must be refinance together at the same time. You cannot have a term loan with bank A and the mortgage with bank B.

When should you refinance?

The best time to consider refinancing is when your mortgage is 6 months to the expiry of lock in or legal clawback period, whichever is later. If you had not obtained legal fees subsidy, then you should just note the lock in expiration date.

Are there expenses incurred for refinancing?

The refinancing expenses are legal and valuation fees. After a period in 2012 with no refinancing subsidy offered by banks, some have resumed offering legal fees subsidy to refinancing. Some offer cash rebate instead, which can help to offset the legal fees. You could be pleased to know that legal fees can be paid by CPF or cash. Valuation must be conducted on the property, to ensure its value is in accordance to the mortgage. We are in touch with the selected banks that offer valuation subsidy too. It’s possible for you to refinance property loan at zero cost with subsidies covering both expenses.

Check out the bank loans that offer refinancing subsidies.

Can I obtain a term loan?

Obtaining a term loan throws another variable in the selection of refinancing banks. Not every bank will provide the same valuation. They may not support the same loan-to-value ratio. Deciding between 80% of $2 million valuation, and 70% of $2.2 million could make a big difference to the possible term loan amount. Note that term loan is only applicable to private properties, and not HDB flats. The good news is the term loan will enjoy the subsidies too.

What is repricing?

Repricing is the act of changing the mortgage with the existing bank. The customer should contact the bank directly to find out the prevailing mortgage repricing packages available. We are not in a position to find out these packages or reprice on your behalf.

Is repricing free?

Those who bought new launches in recent years should enjoy a free one-time repricing. However, there are banks who don’t offer this freebie. Otherwise, be prepared to pay some repricing fees, possibly in the range of $500 upwards. Refinancing could be a cheaper option with lower mortgage rates.

Post-TDSR and MSR

The TDSR guidelines have not certainly made financing easier. Whether you are repricing or refinancing, your borrowing limits will be subjected to assessment again. Application and supporting documents are required. We have seen a fair share of customers who found themselves in sticky situations.

The MSR limit of 30% for HDB flats only have also limit the avenues for HDB owners. Imagine your spouse has stopped working to be a full-time mother and your total income could not pass the MSR criteria. Refinancing would not be possible then. You may use this calculator to assess your MSR.

Contact us today for the best mortgage advice!