On 14 Dec 2016, US Federal Reserve decided to raise interest rates. It came in the wake of Donald Trump triumph. We looked at the reasons behind the US Fed Rate hike, how it affects borrowing costs and the impact on Singapore home loans.

What happened?

So we finally have the first interest rate hike in 2016 by the US Federal Reserve. It happened on 14 Dec 2016, 1 year after the previous hike. All in all, 2 hikes so far, making the overnight lending rate between banks to a range of 0.50% to 0.75%.

What does it mean?

A rise in the borrowing of US dollar between banks will means this costs will be passed on. Rates for car loans will rise, as well as mortgage, and not forgetting cash deposits. Institutional lending will also cost more, so funding of Godzilla purchases by the big boys will be more expensive.

What caused the interest rate hike?

US Federal Reserve officials have mulled over this on regular occasions throughout 2016. There were other concerns or global events that perhaps made them think twice of hiking earlier. In January 2016, the stock market was in turmoil and China equities had a big sell off. Then the unthinkable Brexit occurred. Subsequently, the world saw the election of Donald Trump as the next President of the USA. During these months, US Federal Reserve saw sufficient evidence that the unemployment in USA is getting better and inflation is higher, leading them to this decision. With more people in the workforce, it indicates employers are hiring, more are earning and probably consumers have better abilities to sustain a rise in borrowing costs.

What’s the impact on SIBOR and SOR

If we looked at the impact in 2016 during the first rate hike, the markets have pretty much priced in a hike into SIBOR and SOR. The chart showed the rise in Singapore lending rates after July 2016, way before the actual hike in December. Then SIBOR and SOR tapered off in 2016.

Last week, SIBOR and SOR have also started to rise. As of 13 December 2016, 3-month SIBOR was at 0.926% while 3M SOR was at 0.818%. The magic question on everyone’s lip is whether it will continue to rise.

A key point in the US Federal Reserve decision is the central bank expect THREE 0.25% rate increases in 2017, whereas previously the expectation was TWO. The overnight lending rate may jump from the current range of 0.50% to 0.75% to a range of 1.25% to 1.5%.

We think this is a big change in the biggest central bank of the world. It reflects an improved outlook, positive sentiment and confidence in the largest economy of the world, regardless of what many people think of Donald Trump. We think SIBOR and SOR will rise faster than expected. We don’t have a crystal ball so shall not speculate on how far it can rise to avoid pressure tactics on our customers.

On the following 2 days after the US Fed Reserve decision, the media in Singapore widely reported on trends and forecasts.

- The 3-month Singapore interbank offered rate (3M SIBOR) rose to 0.963 per cent on 15 December 2016.

- 3M SIBOR has increased by 6.7% compared to a month ago.

- The 3-month SOR (swap offer rate) rose to 0.851 per cent on 14 December 2016.

- Victor Yong, United Overseas Bank interest rate strategist, said the SOR, which is more volatile, could rise faster due to capital flight fears from the region.

- CIMB Private Banking economist Song Seng Wun commented that borrowers have to be prepared to pay up to 1 percentage point higher than what they are paying now, up to just under 2 per cent, by the end of the year (2017), if the US interest rates forecast is a guide,” he said.

- Credit Suisse economist Michael Wan said their official forecast for the three-month SIBOR is at 1.75 per cent for next year.”

What’s the impact on Singapore home loans?

Now, let’s do a recap. 3M SIBOR on 1 November 2016 was about 0.87%. It is at 0.963% on 15 December 2016. Credit Suisse forecasts SIBOR to hit 1.75% in 2017. CIMB forecasts effective interest rate to rise by 2%. Home loans pegged to SIBOR will have a margin added to it, where the sum of SIBOR and margin is the effective interest rate payable. Assuming a margin of 0.7% and SIBOR of 1.75%, the home loan rate could be 2.45%. I am shuddering while writing this.

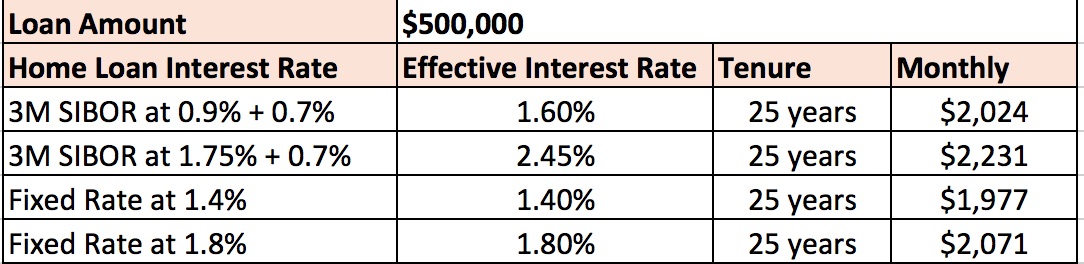

To further illustrate the impact on your home loan repayments, let’s compare SIBOR and prevailing Fixed Rates offered as of December 2016.

Repayments for $500,000 at 1.6% over 25 years is about $2024. If SIBOR rise to 1.75% as forecasted by a Swiss private bank, monthly repayment increases by $207, to $2231. On the other hand, if your home loan is fixed at 1.4% effective rate, you enjoy $1977 constant repayments for the next 24 months. We think fixed rates might go up to 1.8% in early 2017, so you could be servicing the loan slightly more than $2000 a month.

We are certain banks will withdraw current promotional rates. In the aftermath of the US Fed Reserve decision, Bank of China announced the withdrawal of 2-year fixed rate by 23 December 2016. We expect every bank to follow suit. Withdraw, review and re-market will be the strategy of each bank.

However, with Singapore going through a downturn where media reports are peppered with ‘recession’, can YOU withstand a rise in interest rates?

Contact us today for the best mortgage advice!