If you are unsure about how the cooling measures, this article describes the impact on mortgages for private property purchases in Singapore. All latest measures are included in this must-read article.

Financing For First Home Buyer

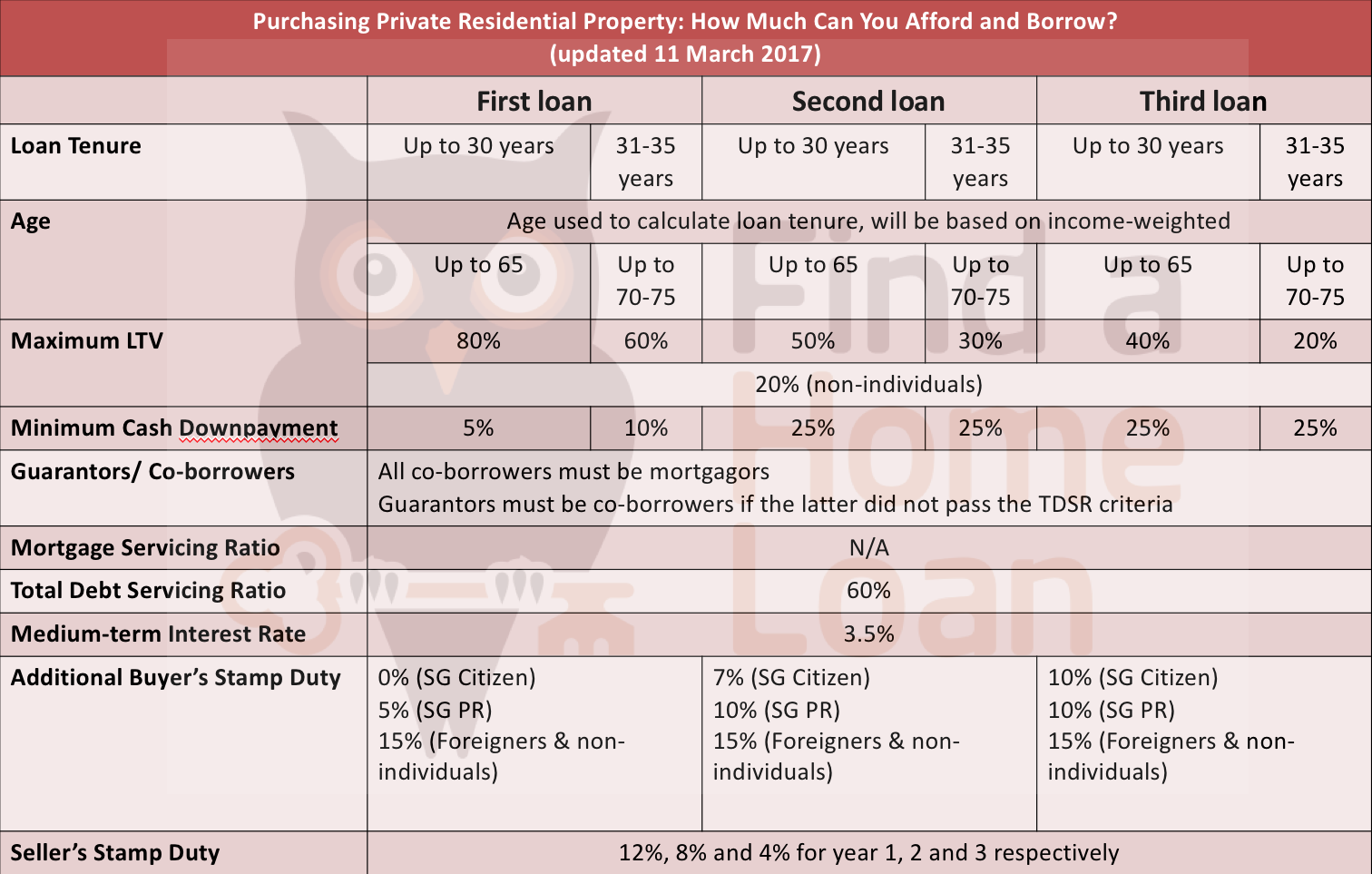

- You can take up to 80% LTV, Loan Tenure is up to 30yrs or age 65 whichever is earlier. If the LTV is 60%, Loan Tenure is extended up to 35 years or age 75 whichever is earlier.

- Take note that 20% Maximum LTV is available for non-individuals that includes operating companies and investment holding companies.

- 5% Minimum Cash Downpayment if LTV is at 80% or 10% Minimum Cash Downpayment for 60% LTV.

- The standard buyer’s stamp duty applies for everyone.

- However, take note of the Additional Buyer’s Stamp Duty. This is payable on top of the buyer’s stamp duty.

- 5% for Singapore Permanent Residents

- 15% for Foreigners & non individuals

Financing A Second Home Loan

- Maximum LTV is at 50%, Loan Tenure is up to 30 years or age 65 whichever is earlier. Otherwise for LTV is 30%, Loan Tenure is stretched up to 35 years or age 75 whichever is earlier.

- 20% Maximum LTV for non individuals.

- Minimum Cash Downpayment of 25% and the rest can be funded from CPF OA.

- Above the stamp duty, the Additional Buyer’s Stamp Duty are as follows:

- 7% (Singapore Citizen)

- 10% (Singapore Permanent Residents)

- 15% ( Foreigners & non individuals)

Financing A Third And Subsequent Home Loan

- Maximum LTV is at 40%, Loan Tenure is up to 30 years or age 65 whichever is earlier. Otherwise for LTV is 20%, Loan Tenure is stretched up to 35 years or age 75 whichever is earlier.

- The minimum Cash Downpayment is set at 25%

- 20% Maximum LTV for non individuals applies.

- While the normal stamp duty applies, the Additional Buyer’s Stamp Duty payable are increased:

- 10% (Singapore Citizen)

- 10% (Singapore Permanent Residents)

- 15% ( Foreigners & non individuals)

Measures That Apply To All

- All co-borrowers must be mortgagors. Conversely, not all mortgagors must be borrowers

- Guarantors must be co-borrowers if the latter did not pass the TDSR criteria

- Mortgage Servicing Ratio (MSR) is not applicable for Private property mortgages

- Subjected to Total Debt Servicing Ratio (TDSR) set at 60%

- Medium–term Interest Rate used for TDSR computation is set at 3.5%

-

Seller’s Stamp Duty (SSD) is revised to 12%, 8%, 4% for year 1, 2 and 3 respectively. SSD is payable if the property is disposed within the first 3 years of purchase on and after 11 March 2017.

-

Other SSD Rates are applicable if the purchase as between 20 Feb 2010 to 10 March 2017.

Contact us today for the best mortgage advice!