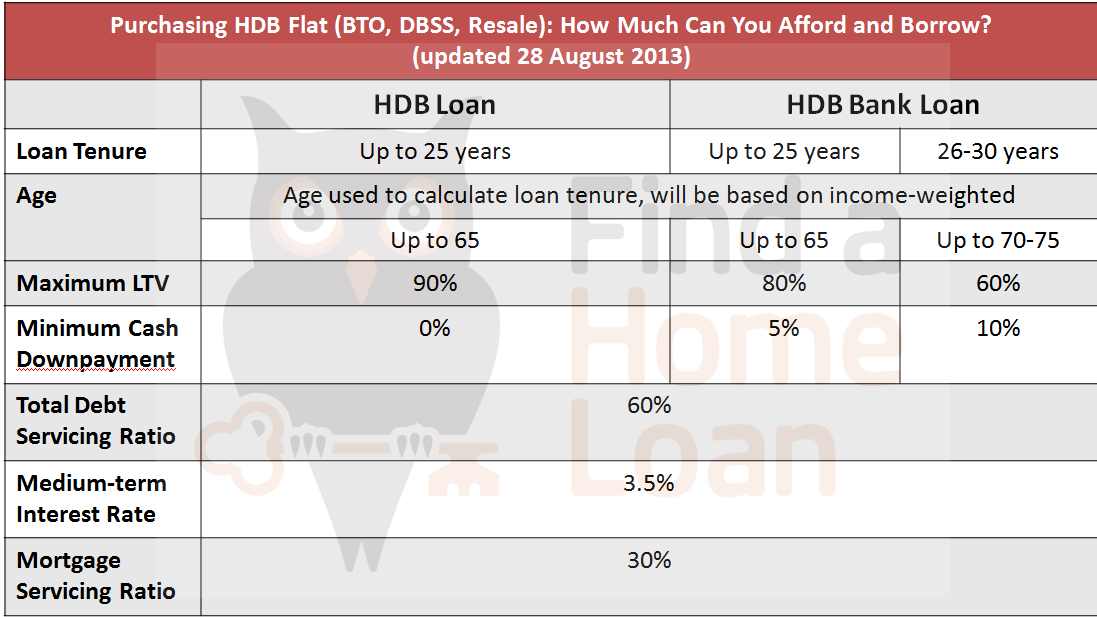

This is the latest matrix showing the financing options for HDB flats in Singapore. You can take up a HDB loan or a bank loan. There are eligibility conditions, TDSR and MSR factors. This article includes the latest announcement by HDB on 27 August 2013 on mortgage tenure and MSR.

- To be eligible for HDB concessionary Loan, your average gross monthly household income cannot be more than:-

- $10,000 for families

- $15,000 for extended families

- $5,000 for singles

- If you do not qualify for HDB Loan, your next option is HDB Bank Loan.

- For HDB concessionary and HDB Bank Loan, if LTV is 80% ,Loan Tenure is up to 25 years or age 65 whichever is earlier. If you borrow 60% or lesser from a bank, the Loan Tenure is up to 30 years and capped at age 75 whichever is earlier.

- Minimum cash downpayment for HDB loan is ZERO. Bank requires a 5% upfront if you borrow up to 80%. For up to 60% LTV borrowing, be prepared for 10% cash. The rest of downpayment can be funded from CPF OA.

- The age of all borrowers used to calculate loan tenure is based on income-weighted. It is not a simple average income of borrowers. It will be adjusted according to the age and income of each person. So it will be biased towards the higher earner and/ or older person.

- Assessment of borrowing limits for HDB loan and bank loan are based on these factors:

For quick self-help assessment, check out the Singapore TDSR calculator and MSR calculator

Contact us today for the best mortgage advice!