Coincidently while having lunch with a friend who recently got hitched, I found out they are looking to purchase their first home! However it seems like most newly married young couple like my friend do not understand the process of getting a loan and what are the desired steps that will lead to a smooth journey in securing a home loan for their first matrimonial home. With so much information and banks to look at, it can be hard to digest. For starters, it would be good to consult home loan comparison companies like us, where our experienced independent mortgage consultants can advise and guide you along the journey. Before you plonk down the deposit for the dream house, you must obtain an Approval In-Principle (known as AIP or IPA).

What is AIP?

An Approval In-Principle is also occasionally known as a pre-approval or in-principle approval for loan. It is an informal non-binding agreement with a bank, on the amount you can borrow and the tenure. Knowing the amount that the bank is likely to grant you, it will help significantly in your financial planning and narrow down your options to choosing the right home that is within your budget and borrowing limits.

Why should you obtain AIP?

Furthermore, getting an AIP is important as it gives you more confidence in the property hunt. Imagine not knowing your borrowing capacity while both of you are in love with the property you just viewed. Do you make an offer on the spot? Or do you hold back, wait to apply with banks and risk losing this property to other buyers? Market talk is property agents are more unlikely to entertain you without an AIP. It’s human nature, isn’t it? If you make an offer without having an AIP, you also risk losing the deposit after banks revert with a lower loan amount. The process of getting an approval can be anywhere from 1 day upwards, depending on the completeness of your documents and complexity of the application. The validity of the approval is usually around 14-30 days (2 weeks to 1 month). Our consultants will look at your documents, profiles and requirements and guide you through the basics of home loans.

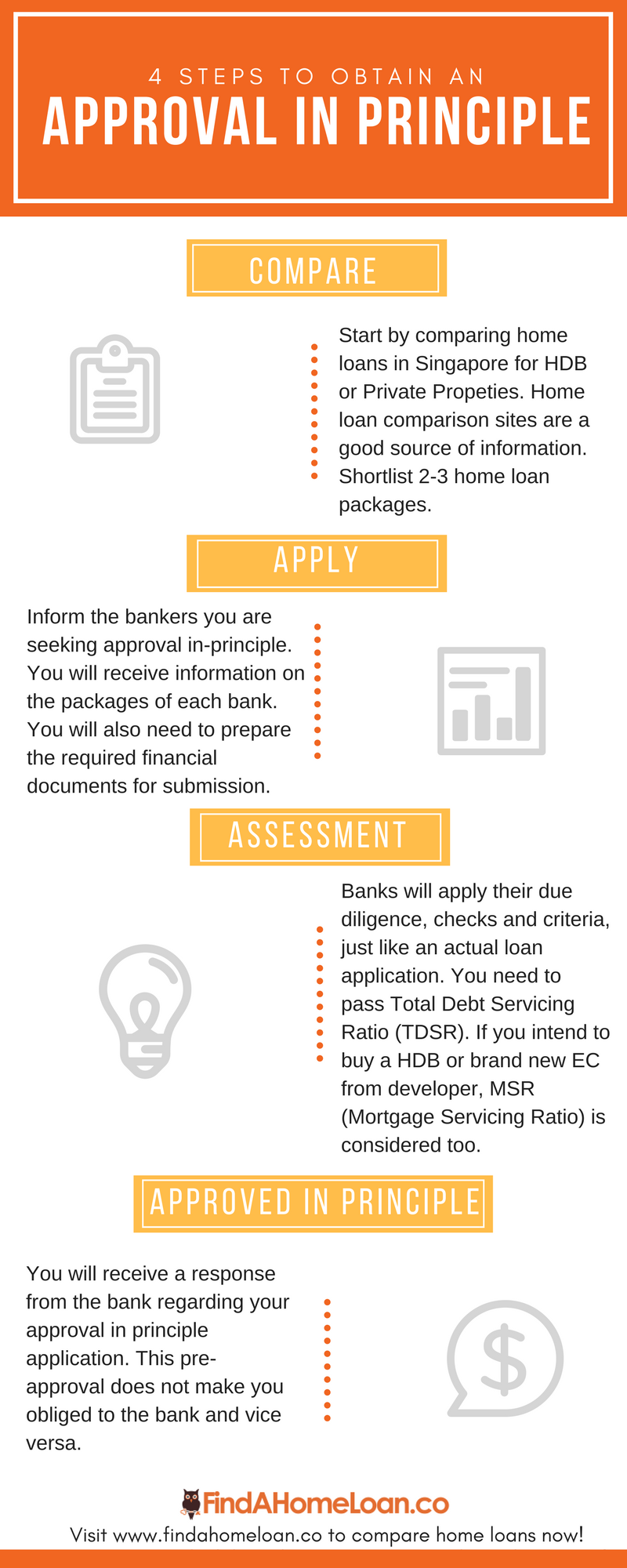

4 Steps to obtain Approval in-Principle

Step 1 : Compare

Start by comparing home loans in Singapore for HDB or Private Properties. Home loan comparison sites are a good source of information. Shortlist 2-3 loan packages.

Step 2 : Apply

Inform the bankers you are seeking approval in-principle. You will receive information on the packages of each bank. You will also need to prepare the required home loan documents for loan submission.

Step 3 : Assessment

Banks will apply their due diligence checks and criteria just like an actual loan application. You need to pass Total Debt Servicing Ratio (TDSR). If you intend to buy a HDB or brand new EC from developer, Mortgage Servicing Ratio (MSR) is considered too. While these can be complicated and you can leave it to our mortgage consultants, you can self-learn more about TDSR and MSR.

Step 4 : Approved in Principle

You will receive a response from us regarding your approval in-principle application. Don’t worry, this pre-approval does not make you obliged to the bank and vice versa. Go ahead to buy with confidence and inform us once your offer is accepted.

Contact us today!